The first-ever report from the Catalytic Climate Finance Facility aims to take stock of current practices in the gender-responsive climate blended finance market, with a focus on energy. The report is divided into three sections.

Part 1 begins with an overview of key data trends in the gender-responsive climate blended finance market, including across sectors, vehicles, regions, and investors.

Part 2 examines five climate finance vehicles that used blended finance structures to support clean energy and gender outcomes.

Part 3 describes the main challenges and recommendations to increase gender-responsive investing within the climate blended finance markets.

A just transition demands closing gender gaps to climate financing. There is growing evidence that women are well positioned to advance climate change mitigation and adaptation goals, and this is particularly true in achieving a just transition. Investing in initiatives that provide women the tools they need enhances climate resilience, spurs more climate innovation, and drives the creation of high-quality green jobs. Despite its strong business case, gender-responsive climate finance remains scarce, particularly in the energy sector. Many factors are responsible for this, including lack of familiarity and technical capacity to develop and incorporate gender considerations into the design of financial vehicles; perceived complexities relating to pursuing multiple impact objectives; and prioritization of other objectives with the perception that gender equality considerations are costly, risky, or incoherent/irrelevant.

Yet, transitioning towards a green economy offers a transformative opportunity to disrupt current gender imbalances—particularly within the energy sector, climate finance’s largest sector and where private sector interest is highest. Climate Policy Initiative (CPI) reports that the energy sector represents 44% of all climate finance. Similarly, Convergence reports 47% of total blended finance flows in emerging markets and developing economies (EMDEs) are in the energy sector.

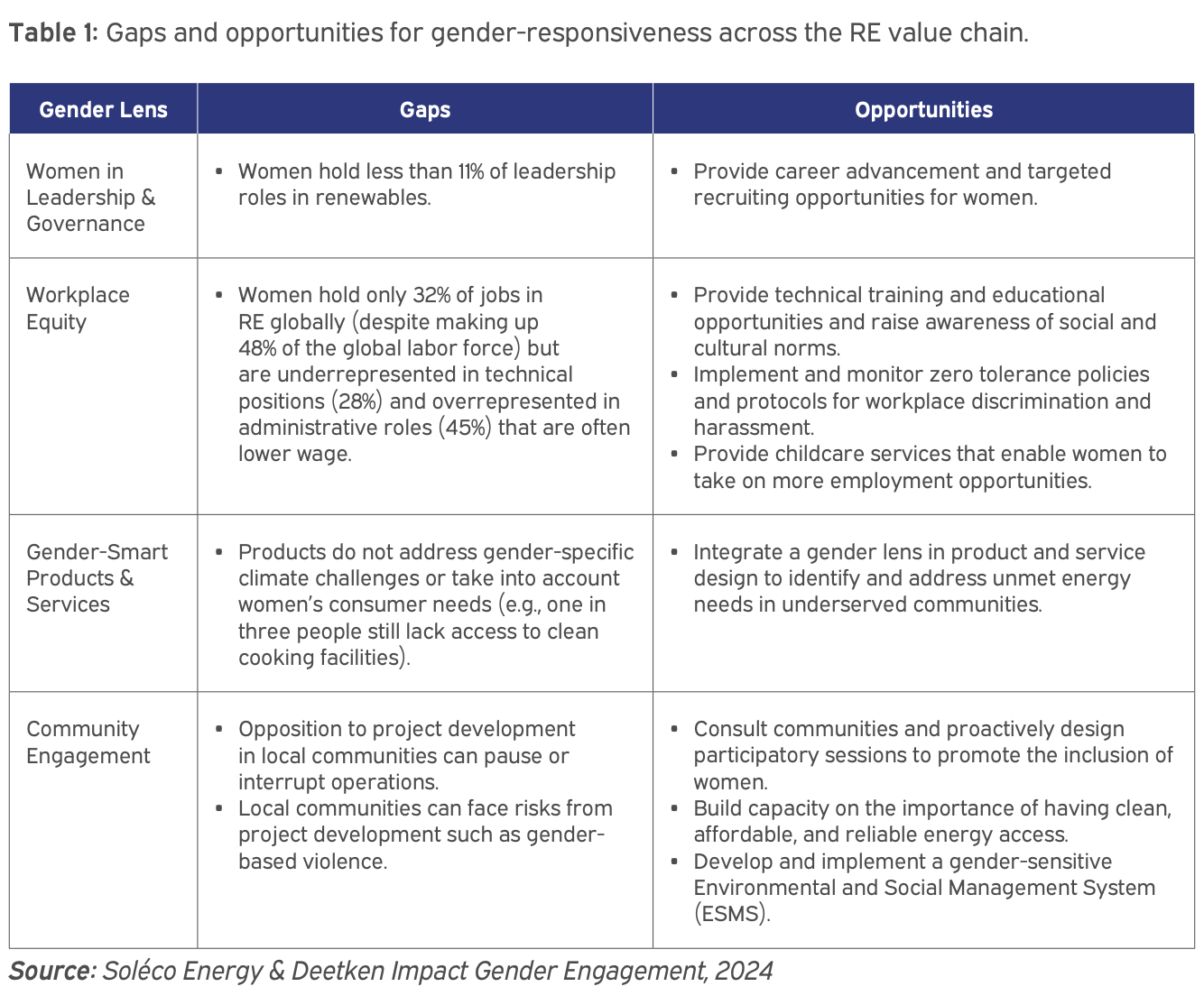

The energy sector faces unique challenges to gender equality. For one, the sector is associated with low female labor rates across the value chain. The International Renewable Energy Agency (IRENA) reports that 32% of jobs in renewable energy (RE) are held by women, and less than 11% when it comes to leadership roles in the sector. In construction, Inter-American Development Bank (IDB) Invest reports the proportion of formally contracted female workers ranges from just 1% to 6%.This report shows that within the energy sector, there has been a higher focus on gender within the off-grid energy sector (28% of off-grid transactions had a gender focus compared to 13% of ongrid). This makes sense given the sector’s association with household energy needs and domestic uses, where women tend to be more represented as both beneficiaries and end-users. It is also easier to measure gender outcomes in off-grid projects, using key performance indicators (KPIs) such as sales and access to off-grid technologies such as clean cooking appliances. Meanwhile, only 13% of large-scale energy transactions include a gender focus. The report also finds that this can be partially explained by some of the difficulties associated with project finance, where investors are removed from the underlying policies influencing gender, as well as difficulties mainstreaming gender both within technical and non-traditional roles. The table below summarizes gaps and opportunities to create gender-responsive strategies within RE transactions.

Increasingly, initiatives are arising to overcome these barriers, build technical capacity, and increase familiarity with investing in gender-responsive products. Blended finance is one approach that has successfully spurred capital into gender-responsive climate action in EMDEs, attracting private finance both to mitigation and adaptation sectors. Blended finance also offers useful financial tools to promote gender outcomes within the market. This includes the provision of early-stage acceleration grants to help business models incorporate gender considerations into the design of their financial vehicles; technical assistance (TA) to help fund managers and project sponsors create gender action plans and identify women-led pipelines; and performance-based incentives that offer financial benefits such as interest rate reductions for borrowers who meet gender targets.

This report aims to take stock of current practices in the gender-responsive climate blended finance market, with a focus on energy. The report is divided into three sections:

Part 1 begins with an overview of key data trends in the gender-responsive climate blended finance market, including across sectors, vehicles, regions, and investors. Key findings include the following:

• Out of the 551 climate blended finance deals in Convergence’s Historical Deals Database (HDD), only 22% were gender-responsive. This is considerably lower than the overall trend in the blended finance market where 31% of the deals were gender-responsive.

• Although climate adaptation and hybrid (i.e. transactions that contain elements of both climate mitigation and adaptation finance) deals constitute a smaller portion of the overall climate blended finance market, they are more likely to be gender-responsive.

• Gender-responsive climate deals are largely driven by public investors in North America and Europe, with very few investments originating from local markets in developing regions. The top investors that focus on gender-responsive climate finance are multilateral development banks (MDBs) and development finance institutions (DFIs), followed by development agencies. In contrast, the proportion of private sector investors in these transactions remains lower than the public investors.

• Concessional debt or equity is the predominant blended finance archetype in gender-responsive climate blended finance deals (86% of transactions). Concessional loans, including performance or KPI linked loans tied to gender outcomes, are common tools to incentivize gender equity within climate blended finance vehicles. Similarly, TA funds are often used (39% of transactions), to help investees (in the case of fund structures) and deal sponsors (in the case of direct investments) streamline gender within their business operations and pipeline.

Part 2 examines five climate finance vehicles that used blended finance structures to support clean energy and gender outcomes. These case studies cover the following five transactions:

1. Green Guarantee Company (GGC)

2. Catalyst Fund

3. Local Utility Project Accelerator (LUPA)

4. Beyond Finance

5. Sistema.bio

Part 3 describes the main challenges and recommendations to increase gender-responsive investing within the climate blended finance markets. Key recommendations include:

• Concessional capital providers should provide acceleration support and design funding grants when assisting first-time deal sponsors to integrate a gender lens.

• It is good practice to deploy TA and financial incentives together to achieve complementary and coordinated goals.

• Practitioners should use TA to move beyond a “counting heads” approach to gender outcomes.