About

Demographic trends in Africa and Asia necessitate massive investment in affordable homes for the hundreds of millions people living in sub-standard housing. As buildings account for 37% of energy-related GHG emissions globally, it is imperative that this housing gap is met with a housing stock that is more sustainable than that which exists today.

Well-built, energy- and water-efficient housing can help marginalized communities adapt to climate-linked disasters, including extreme heat, flooding, drought, and tropical cyclones, while secure tenure and low energy bills provide a route to long-term financial independence and resilience.

However, a chronic lack of finance for developers and prospective homeowners constrains the construction of climate-smart affordable homes at the scale required to address these challenges.

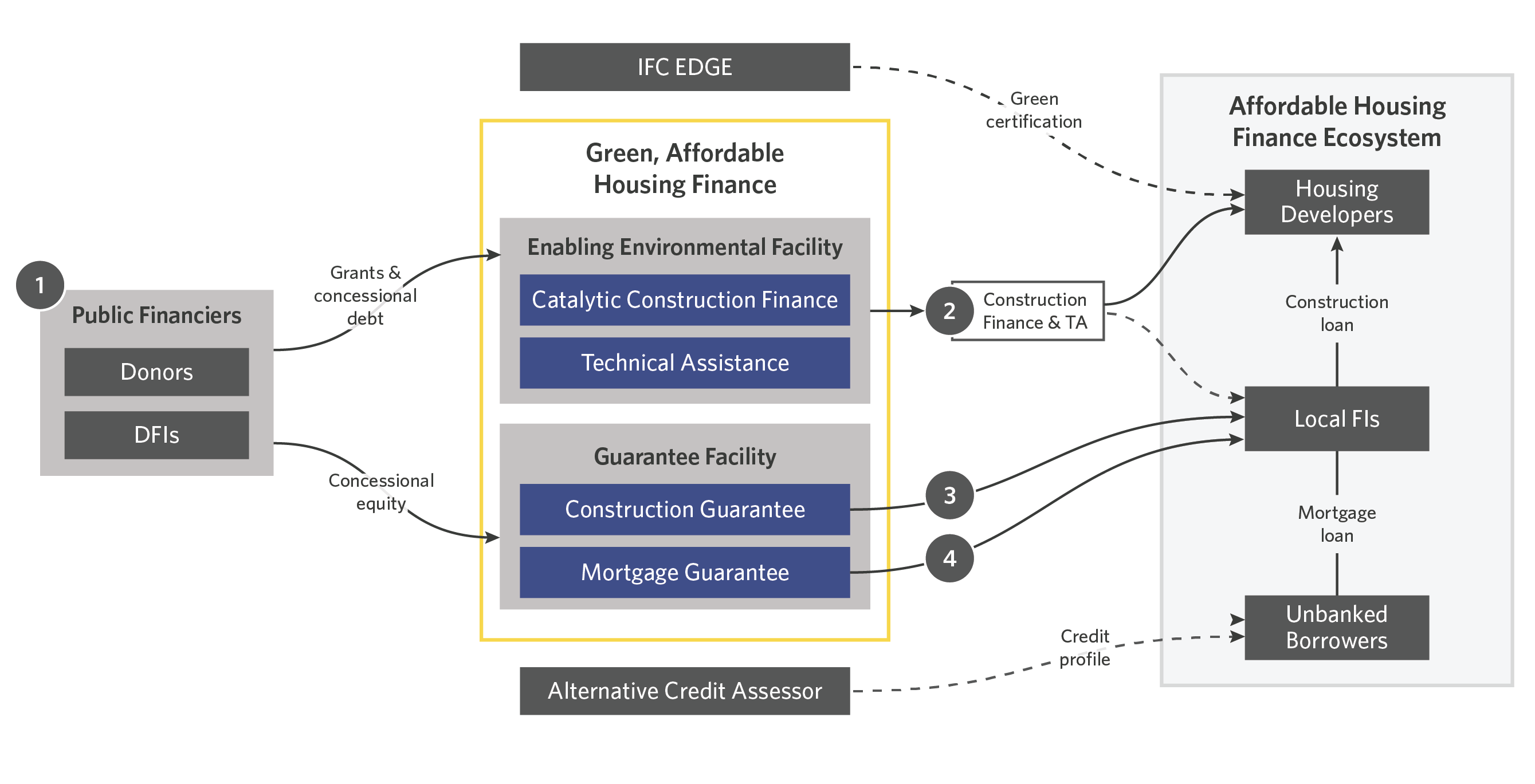

Green Affordable Housing Finance deploys construction and mortgage loan guarantees alongside targeted enabling interventions to foster a locally driven and self-sustaining affordable housing finance ecosystem

INNOVATION

Green Affordable Housing Finance’s core innovation lies in its capacity to incentivize local lenders to finance both construction of affordable green homes and the purchase of those homes by households with low and informal incomes. It does this through the coordinated deployment of construction and mortgage loan guarantees to support the supply and demand side of the affordable housing sector. In doing so, the instrument aims to build the foundation for an eventual self-sustaining housing finance ecosystem for climate-smart, affordable homes.

IMPACT

Reall will pilot the instrument in Kenya before expanding throughout Sub-Saharan Africa and South Asia. All homes supported by the instrument will meet industry standard green certification requirements and target populations unserved by conventional housing finance solutions. Over time, the instrument will target increasingly innovative and high-impact home designs as it approaches net zero construction. During the five-year pilot phase, the Guarantee Facility is expected to mobilize USD 37 million in lending activity for green, affordable homes. Upon scale-up, the guarantee facility is expected to support over USD 400 million in local private loans over 15 years.

DESIGN

The instrument will capitalize an Enabling Environment Facility (EEF) and a Guarantee Facility to provide coordinated support for green affordable homes across the housing finance value chain.

To catalyze new housing supply, the EEF will deploy targeted construction finance and technical assistance to allow high-impact local developers to establish an operating track record and attain bankability. Meanwhile, the Guarantee Facility will de-risk construction loans issued by local lenders to further scale the development of certified green affordable homes.

In parallel, the EEF will support local lenders in adopting alternative credit assessment to underwrite borrowers with low and informal incomes. The Guarantee Facility will then de-risk mortgages for those borrowers to expand credit access and offtake for developers of green affordable homes.

The deployment of technical assistance and construction finance via the EEF alongside construction and mortgage guarantees via the Guarantee Facility provides a value chain approach to accelerating the development of a self-sustaining housing finance ecosystem.