This is the second entry of a ten-part blog series celebrating the Lab’s 10th anniversary. The series will share valuable insights and lessons learned over the past decade, exploring practical knowledge gained from accelerating climate finance solutions in emerging markets. See all entries here.

July 23, 2024

Imagine you are designing a financial instrument to promote sustainable land management practices among Southeast Asian farmers. You envision this will reduce deforestation, improve soil health, and increase carbon sequestration. But how can you quantify these expected outcomes to demonstrate the return on your investment?

Social and environmental modeling is an essential yet tricky aspect of climate finance. Investors increasingly seek to estimate their investments’ environmental and social outcomes. However, establishing and measuring these metrics can be challenging.

Climate finance innovators often struggle to establish a logical impact framework that fully grasps the social and environmental context they aim to address with their financial instruments. This can make it difficult to define and communicate the impact of potential solutions.

At the Global Innovation Lab for Climate Finance (the Lab), we have found that designing a Theory of Change (ToC) is an effective tool for integrating impact considerations into climate finance mechanisms. For the past ten years, the Lab’s team of experts has worked with several innovators to develop robust ToCs, resulting in better-designed climate finance solutions with a clearer path toward achieving social and environmental goals. But how do we do it?

Understanding the Theory of Change

A ToC is a roadmap that outlines the steps required to achieve desired goals. It lays out the pathway from activities to outputs (direct results of activities), outcomes (short- to medium-term effects), and impacts (long-term, significant changes).

The value of the ToC lies in its ability to provide a clear, visual representation of a project’s goals and the necessary steps to achieve them in a cause-and-effect chain. This helps to clarify the assumptions and causal linkages that underpin a project or initiative.

It serves as a planning and communication tool, ensuring that all stakeholders understand the objectives and the means to attain them. This clarity is invaluable for social and environmental modeling.

Integrating a ToC into the Lab process of developing climate finance instruments complements the detailed design of financial mechanisms. Here’s how the Lab defines the key elements of this framework:

- Activities: The core set of 4-8 actions the instrument will take to solve the problem and achieve its goals. These might include developing a pipeline of projects, gathering data, mapping key financial flows, or conducting due diligence.

- Outputs: The direct, measurable deliverables of the activities, including immediate practices, products, and services. Outputs are typically directly within the control of the project.

- Outcomes: The results the instrument aims to achieve through its activities. Outcomes are influenced by the project but not directly controlled by it. They are typically measured over longer timeframes.

- Impact objectives: The broader mission statement describes the instrument’s overarching influence, typically spanning 2-3 key areas. While not directly measurable, the impact objectives should connect to the project’s activities, outputs, and outcomes.

- Goal: A core, concise statement summarizing the instrument’s overarching purpose.

Outputs, outcomes, and impact indicators should naturally emerge from a well-crafted ToC to measure anticipated results. When these indicators are chosen independently of a ToC, they may not align well with the intervention. Therefore, having a clear ToC is crucial to selecting appropriate indicators, defining success, and measuring impact.

ToC enhances social and environmental modeling

Once the ToC is established, the Lab leverages its expertise to translate qualitative aspects into quantitative indicators. This may involve researching existing benchmarks for similar projects, identifying relevant data sources, and developing data collection and analysis methodologies.

While not an exact science, this marks an earnest attempt to quantify the impact achieved per dollar invested. For instance, each dollar allocated might abate a certain amount of CO2 emissions. Determining this factor—how each dollar translates into impact—is a significant challenge, and the Lab often supports proponents in addressing it.

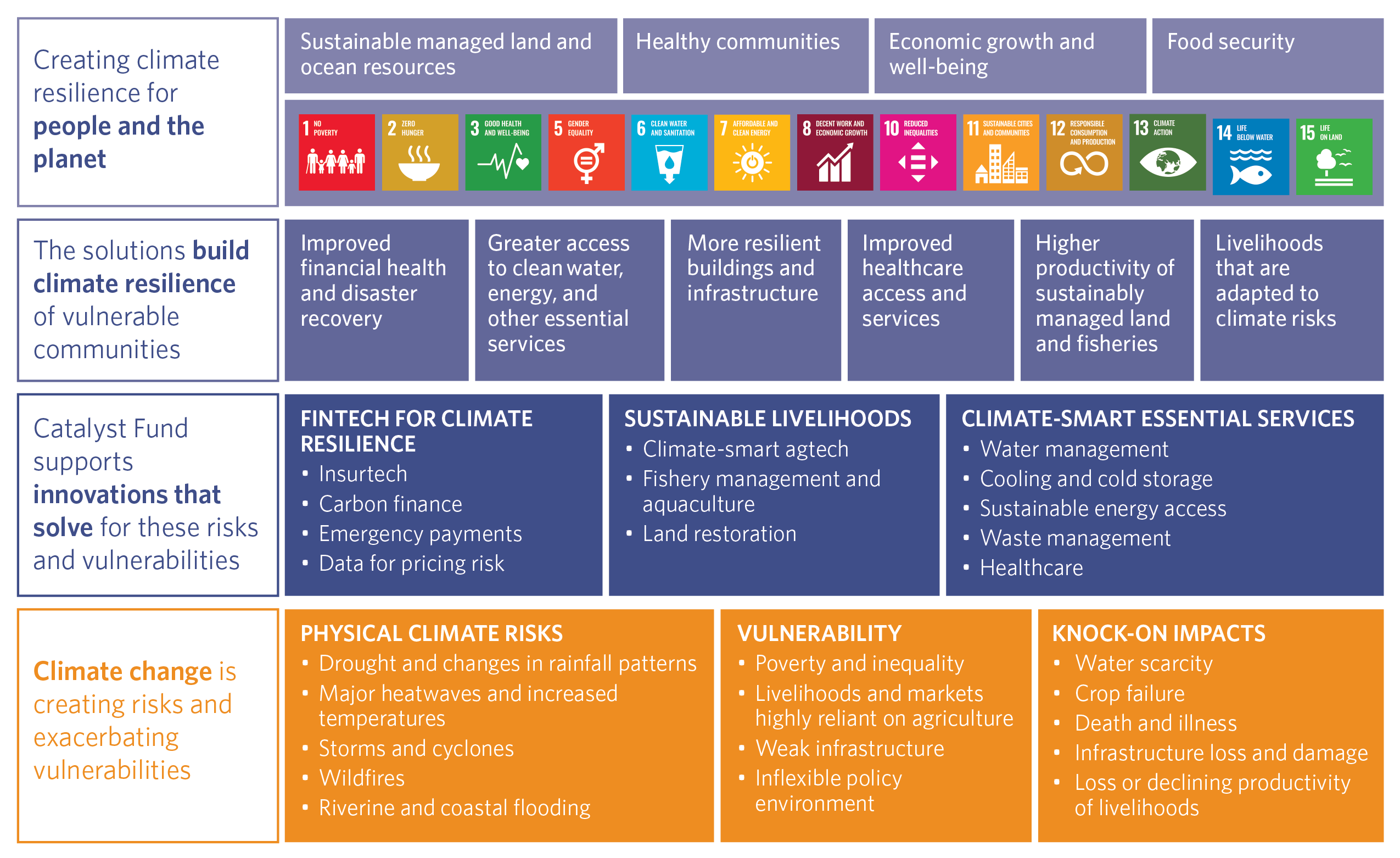

Integrating a ToC into developing climate finance instruments has shown significant benefits. This approach is exemplified by the 2023 Lab alumnus Catalyst Fund, which provides equity and hands-on venture-building support to startups building climate adaptation capabilities in Africa to help them achieve product-market fit.

The process solidified the fund’s key investment verticals (Fintech for Resilience, Sustainable Livelihoods, and Climate-Smart Essential Services) and linked specific activities to broader resilience outcomes. This clear cause-and-effect pathway allowed the fund to select relevant and precise outcomes and impact metrics aligned with its overarching goals for the startups in its pipeline.

For instance, within the Fintech for Resilience investment vertical, the fund targets a resilience outcome of improved access to financial services that build financial health and allow households to cope with climate risks. They have structured a related set of output metrics, including the percentage of users using insurance for the first time and the number of loans deployed. These and other metrics prove the fund’s effectiveness and investments’ positive social and environmental outcomes.

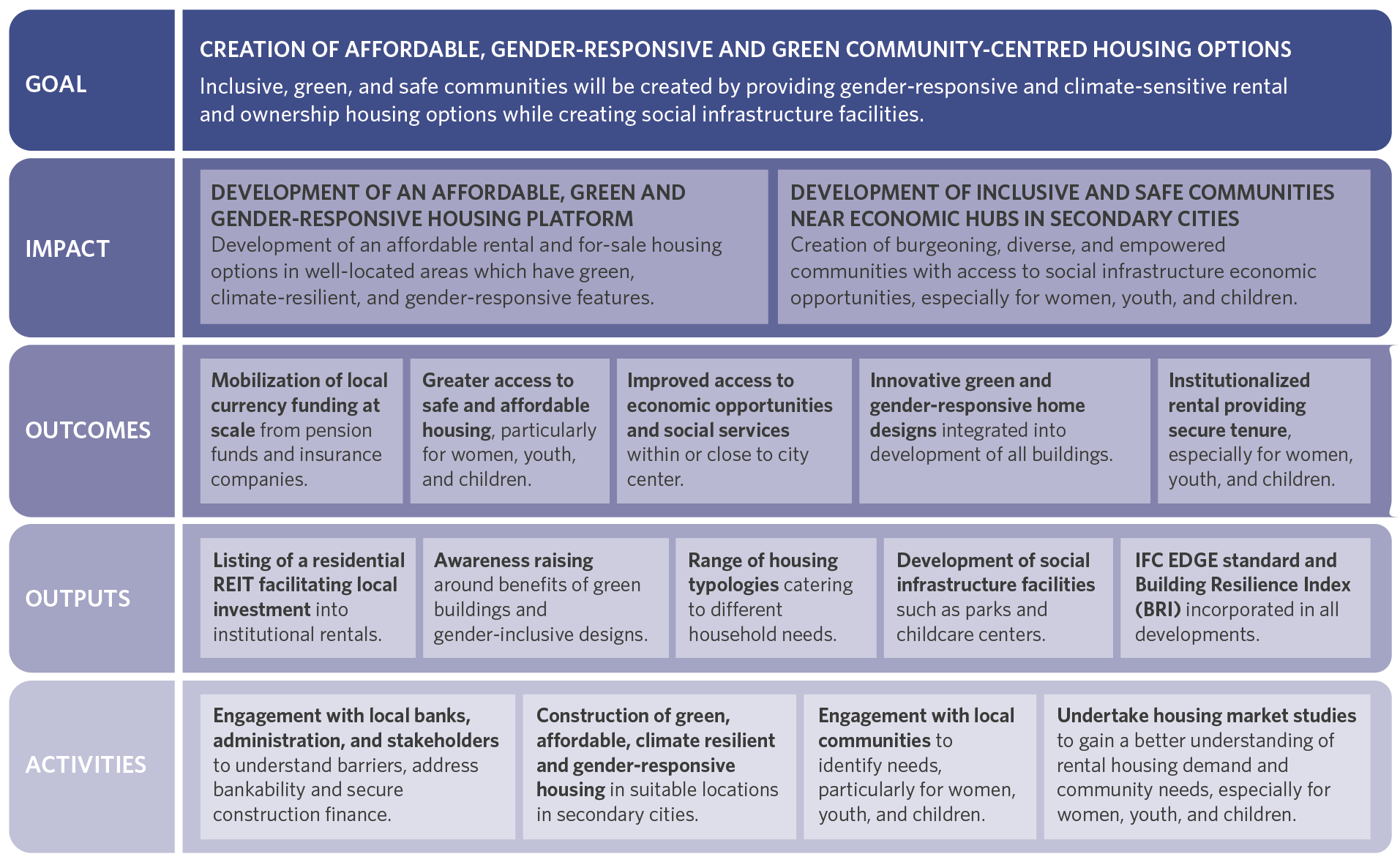

Measuring gender equality in housing

Another example is Social Infra Ventures (SIV), a groundbreaking rental and for-sale gender-responsive, green, affordable housing platform in Northern Africa. When joining the Lab program in 2023, SIV’s proponents knew they wanted to focus on gender-positive affordable housing but lacked clarity on defining and measuring it. Without a clear definition or metrics for success, SIV would have struggled to demonstrate the impact its housing developments would have on women.

The Lab’s ToC prompted SIV to identify specific impact objectives, consider gender-responsive design features, and develop measurable outcomes and outputs. An example is the development of social and infrastructure facilities such as parks and childcare centers. This output directly translates into the number of products and services that benefit women, a key impact metric for SIV.

Improving instrument design

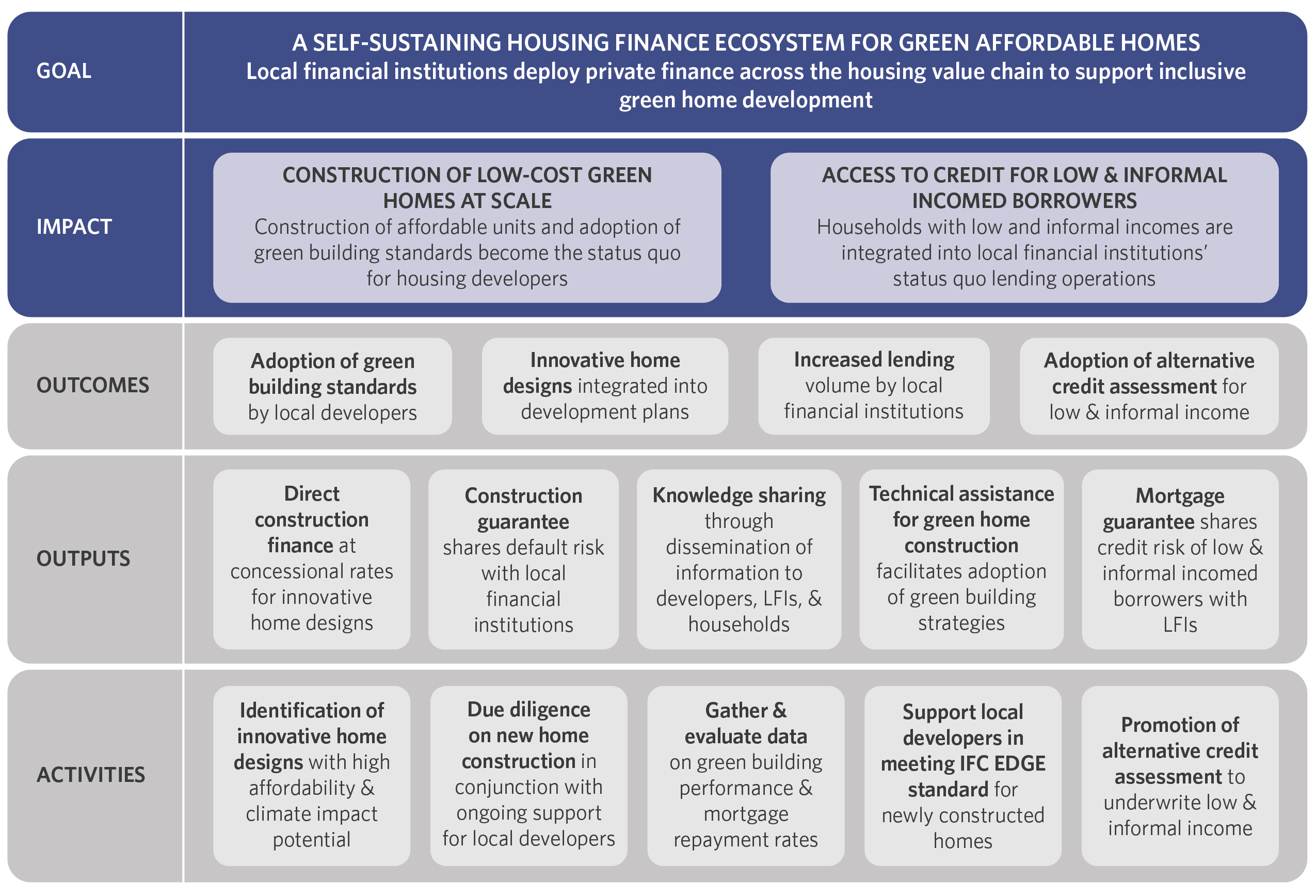

The Lab’s ToC framework can also inform instrument design. Take, for example, the Green Affordable Housing Finance, a 2022 Lab instrument that deploys a combination of guarantees for construction loans and mortgages with targeted capacity-building interventions to foster a locally driven and self-sustaining affordable housing finance ecosystem.

Lab proponent Reall originally planned to focus only on household access to credit, but the ToC showed that access to credit for housing developers was also a constraint. That led to the instrument guaranteeing construction loans and mortgages, enhancing how the instrument would target systemic change in a complex system with many different actors and steps.

Addressing challenges and future opportunities

A well-designed ToC can help clarify the components needed to drive impact. If you understand these resources, you can estimate the value of an expected outcome. This can help translate the investment into the outcomes and impact you aim for in the report.

Doing so requires shifting from focusing solely on financial returns to considering broader social and environmental effects. Developing a comprehensive ToC can be time-consuming and requires collaboration among various stakeholders.

However, the potential rewards make this effort worthwhile. By systematically incorporating a ToC into their development processes, climate finance initiatives can improve their impact projections and become more effective investments. As more data becomes available from implemented projects, these ToCs can be refined and used to develop industry benchmarks and best practices.

Looking ahead, The Lab sees potential in fostering collaboration across institutions to standardize impact metrics and methodologies. By leveraging the collective insights from a diverse portfolio of projects, they can contribute to a more consistent and credible approach to social and environmental modeling.

Check out the entire Lab 10th Anniversary blog series

1. Five strategies to break down barriers to private climate investment

2. How a well-designed theory of change guides clearer social and environmental modeling

3. Building a compelling investment case for climate finance instruments

4. Making the most of concessional capital: The Lab’s blended finance approach

5. Enhancing the appeal of small-ticket investments with Sustainable Energy Bonds in India

6. Why Climate Adaptation Notes didn’t take off – and the lessons I learned

7. How Brazil’s Green FIDC became the Lab’s champion for private investment mobilization

8. Adaptation finance: Six key steps for structuring instruments that deliver results

9. Beyond box-ticking: Why gender-responsive climate finance is effective climate finance

10. Emerging trends, opportunities, and challenges in climate finance (17 September)

BONUS: A decade of the Lab: Finding a balance between climate finance and actionability (25 September)