New York, 3 October 2024 – The Global Innovation Lab for Climate Finance (the Lab) gathered last week in New York to endorse its 2024 class of innovative climate finance solutions. The class features 10 ideas across five regional programs and three thematic streams.

The combined investment opportunities in this class total USD 490.5 million, targeting philanthropic, public, and private investors. Pilot projects are planned in various countries, including Brazil, Colombia, India, Mexico, the Philippines, and South Africa.

The solutions tackle various challenges, such as expanding access to renewable energy for low-income households, promoting gender equity in climate-smart agriculture, supporting sustainable and regenerative land management practices, and improving urban infrastructure resilience to reduce food waste and emissions.

The Lab is a public-private initiative that aims to accelerate the development of innovative climate finance solutions and instruments to unlock private capital for emerging and developing countries. It brings together over 100 institutions from government, development finance, philanthropy, and the private sector to identify, develop, and launch promising ideas for sustainable investment.

The Lab’s endorsement was part of its 10th-Emery offices during New York Climate Week. Additionally, the publication A Decade of Climate Finance Innovation: Impact Lessons from the Lab was released, highlighting key insights into the challenges faced and successes achieved since the Lab’s launch in 2014. The Lab has now supported 78 instruments that have collectively mobilized more than USD 4 billion for climate action.

The 2024 cohort’s 10 solutions

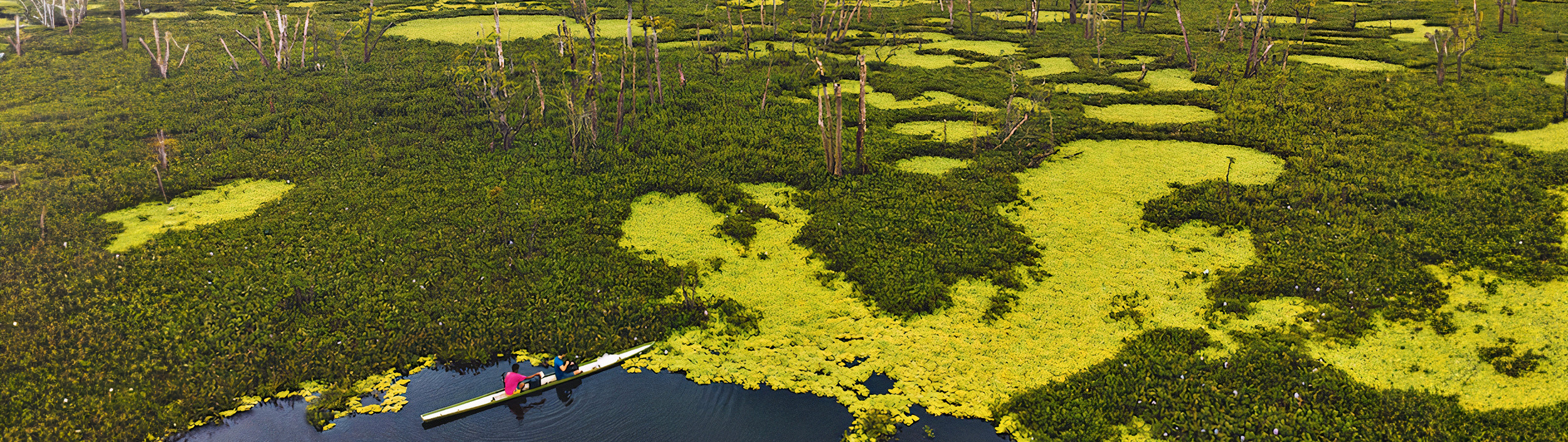

Amazon Food&Forest Financing Initiative provides financial support through a fintech platform that aims to enhance the bankability of local regenerative businesses in Brazil. The initiative aggregates cross-sectoral projects and fosters partnerships with ecosystem enablers to help promote the development of socio-bioeconomy businesses.

Clean Utilities for Affordable Housing expands access to renewable energy for low-income households in South Africa by partnering with landlords and using credit enhancement strategies to attract large-scale commercial capital.

Growth Next-Generation Agriculture is a climate resilience debt fund accelerating Brazil’s transition to regenerative agriculture. It works by financing the purchase of biological inputs by farmers from local small and medium-sized enterprises (SMEs).

InvestHER Climate Resilience Bond promotes climate-smart agriculture practices and gender mainstreaming by improving access to credit for women-led or owned agri-SMEs and providing technical assistance to enhance their impact on women farmers. A pilot is planned for Uganda.

Regenera Ventures Fund invests, mainly through redeemable equity, in companies within the agriculture, forestry, ecotourism, rural management and food systems sector in Mexico. Supplementing their financial offering with technical support, the fund provides the tools for companies to plan, implement, and scale regenerative management, helping increase climate resilience.

Resilient Municipal Market Fund (ReMark) supports municipal markets across Africa to build urban infrastructure resilience, reduce food waste, improve food security, safeguard vulnerable livelihoods, and reduce greenhouse gas emissions. The instrument will be piloted in Kenya, Mozambique, South Africa, Tanzania, and Zambia.

SPV for Silvopasture Scaling is a special purpose vehicle that enables the adoption of more sustainable practices in Colombia. These practices lead to reduced emissions, increased carbon sequestration, and the recovery of degraded land. They also contribute to greater income generation for medium-sized farms and enhanced climate resilience.

Structured Finance for Nature stacks green bonds to finance a diversified portfolio of natural assets, with 60% of proceeds dedicated to protecting intact ecosystems. A pilot is planned in the Philippines.

CoolPact Capital India Fund will invest USD 100 million in early-stage cooling solutions in India. The country’s first blended capital equity fund focused exclusively on cooling aims to de-risk and scale innovative cooling technologies, addressing climate change and the UN Sustainable Development Goals.

The Landbanking Group has created a new methodology for valuing nature and a market mechanism (Nature Equity Assets) to allow direct investment into natural capital stocks: biodiversity, carbon, soil, and water. The initiative will be piloted in Brazil.

Quotes

Barbara Buchner, Global Managing Director, Climate Policy Initiative: “As we wrap up our first decade with the Lab, its lessons will help inform what the next decade of climate finance will look like and how we can get to the scale needed. These 10 ideas, and the Lab’s entire portfolio of almost 80 instruments, show the catalytic potential when the public, private, and philanthropic sectors collaborate to turn ambition into action.”

Ben Broché, Associate Director, Climate Policy Initiative: “Each of the ideas offers innovative solutions needed to address key barriers and bridge the climate finance gap. We’re proud to see how these solutions have evolved over the last six months, paving the way for USD 490 million in investment opportunities.”

Pallavi Sherikar, Senior Advisor, U.S. Office of the Special Presidential Envoy for Climate. “We have been a proud supporter of the Global Innovation Lab for Climate Finance since its inception and are pleased with how it has helped drive investment into climate solutions for the past decade. Three years ago, we worked with the Lab to launch an inaugural window for climate adaptation to help elevate and stimulate ideas focused on building climate resilience. With the new support we announced at the Lab Meeting, we are thrilled to be able to sustain the adaptation windows and create a new workstream focused on assessing novel adaptation financing structures for small island developing state economies.”

Jorim Schraven, Director, Impact department, FMO: “I’m particularly impressed by the diversity of sectors the Lab’s 2024 class explores, from food markets to residential real estate and innovative forest projects. They represent some truly focused and well-thought-out proposals, considering the team’s expertise and how to drive impact through innovative financial approaches. This exciting Lab class can potentially mobilize significant investments for climate action.”

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

Contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org