San Francisco, 13 December 2023 – As climate finance takes center stage at COP28, the Global Innovation Lab for Climate Finance (The Lab) celebrates a significant milestone: its portfolio of climate finance solutions has now mobilized over USD 4 billion in sustainable investments across emerging markets. This represents commitments from over 130 diverse public and private investors, many of whom are part of The Lab’s network.

Of The Lab’s 68 climate finance solutions, 37 have attracted financial support, revealing an exceptional 54% mobilization rate. These achievements underscore The Lab’s growing impact in channeling critical resources towards climate action where it’s needed most.

The Lab, an initiative backed by over 70 prominent public and private investors and institutions, accelerates the development and deployment of innovative financial solutions that unlock private capital at scale and support sustainable development goals in emerging economies. Climate Policy Initiative (CPI) serves as the Secretariat and analytical provider.

“The Lab’s diverse toolkit caters to a wide range of sectors, addressing both mitigation and adaptation needs,” says CPI’s Global Managing Director Barbara Buchner. “It offers practical blueprints for scaling up finance towards a resilient, net-zero future. We all see at COP28 in Dubai that time is ticking for unlocking the trillions needed. The Lab’s solutions show us multiple ways to get it done.”

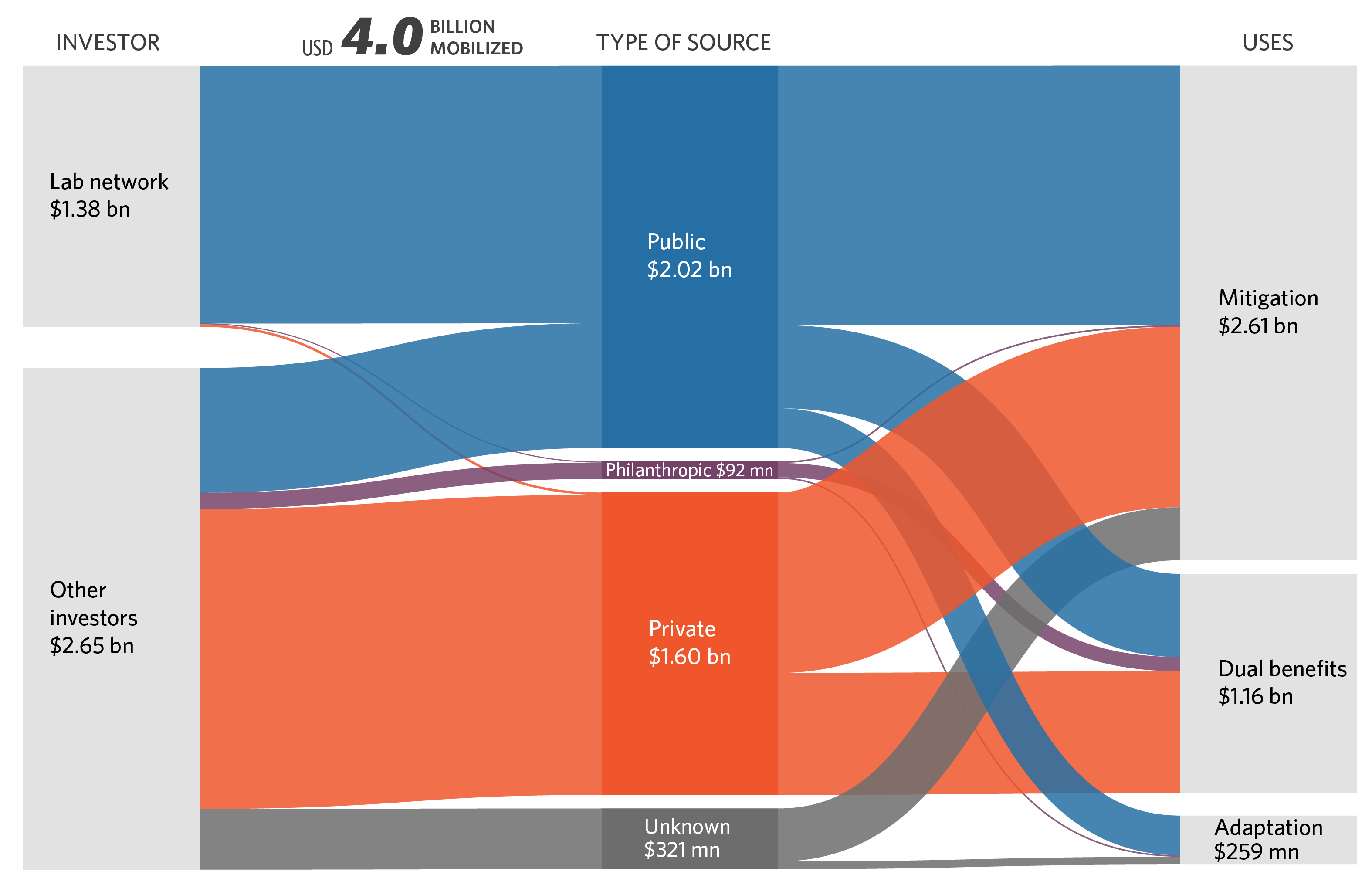

The USD 4 billion includes more than USD 1.3 billion in investment from the Lab network and over USD 1.6 billion in private finance. The Lab has incubated financial instruments that target every region of the world. It has been endorsed by the G7, India, and Brazil governments and won the 2021 UN Global Climate Action Awards for Climate Financing.

Breaking down the impact (not cumulative)

- USD 2.8 billion mobilized for mitigation efforts

- USD 258 million for adaptation initiatives

- USD 1.2 billion delivering dual mitigation and adaptation benefits

- USD 1.6 billion (40%) secured from private sector investors

- USD 1.3 billion mobilized through The Lab’s network

- USD 2.7 billion catalyzed from other investors

“This announcement is perfectly timed as we prepare to welcome our largest Lab cohort yet in 2024. We’ve witnessed how these climate finance solutions unlock capital across sectors, delivering tangible results across the Global South,” said Climate Policy Initiative’s Associate Director Ben Broché, who leads the Lab’s efforts.

Recent Lab solutions progress

- Green Guarantee Company (GGC): A USD 100 million initial balance sheet is being assembled by a consortium including the United States – through USAID, the State Department, and Prosper Africa – alongside the UK’s Foreign Commonwealth and Development Office, the Green Climate Fund, Norfund, and the Nigerian Sovereign Investment Authority. The GGC is the first specialist guarantor for emerging market climate adaptation and mitigation projects, unlocking access to global investors by de-risking green bonds and loans.

- Responsible Commodities Facility (RCF): This 2018 Lab instrument has expanded its capital from USD 11 million to USD 47 million with the support of major commercial banks. RCF provides financial incentives to produce soy in existing cleared and degraded lands to discourage further agricultural land expansion in the Brazilian Cerrado.

- Climate Investor Two (CI2): Managed by Climate Fund Managers, CI2 has locked in an additional USD 20 million, reaching a third close at USD 875 million. CI2 focuses on water, sanitation, and ocean infrastructure in emerging markets.

2024 Call for Ideas

The Lab has an open call for innovative solutions to tackle barriers hindering climate investments in emerging markets while supporting a net-zero transition. The call is open until December 27th, with ten selected ideas set for development in 2024.

2024 marks The Lab’s tenth anniversary, and the upcoming cohort promises to be the most extensive yet. The Lab is introducing two new regional programs — one in Latin America and the Caribbean and another in the Philippines — and launching a new thematic stream targeting high-integrity forests.

About the Lab

The Global Innovation Lab for Climate Finance identifies, develops, and launches innovative finance instruments that can drive billions in private investment to action on climate change and sustainable development. Bloomberg Philanthropies, the United Nations Development Programme, and the governments of Canada, Germany, the United Kingdom, and the United States fund the Lab’s 2024 programs. Climate Policy Initiative serves as the Secretariat and analytical provider.

Contact:

Júlio Lubianco

Communications Manager

julio.lubianco@cpiglobal.org

Sam Goodman

Communications Associate

sam.goodman@cpiglobal.org