This is the first entry of a ten-part blog series celebrating the Lab’s 10th anniversary. The series will share valuable insights and lessons learned over the past decade, exploring practical knowledge gained from accelerating climate finance solutions in emerging markets. See all entries here.

July 16, 2024

Emerging markets and developing economies face significant challenges in attracting investment to mitigate greenhouse gas emissions and adapt to climate change. Finance needs in these markets are projected to reach USD 2.4 trillion annually by 2030, presenting a substantial opportunity for private investment.

Despite controlling the world’s largest pool of assets, private institutional investors and commercial banks have played a limited role in funding climate solutions in developing economies due to both real and perceived risks at the macro and micro levels.[1] In Sub-saharan Africa, for example, private finance accounts for less than a third of all climate finance.

Over the past decade, the Global Innovation Lab for Climate Finance (the Lab) has been on a mission to bridge the private finance gap for climate-related investment. Since its establishment in 2014, the Lab has supported 68 climate finance instruments that have collectively mobilized over USD 4 billion, with USD 1.6 billion coming from the private sector. Through this work, we have developed a robust knowledge base on various approaches that help projects reach commercial viability and attract private investment.

The Lab tackles two main barriers to climate investment in emerging markets: acute and chronic risks.

- Acute risks are specific to a project stage, occur at different points during the project cycle, and typically play out at the micro level. Some examples of highly acute risks are burdensome administrative processes and insufficient project size. Moderately acute risks include limited technical capacity, lack of data, and inadequate physical infrastructure. Lab instruments have most successfully addressed acute risks in their design.

- Chronic risks are long-term uncertainties throughout a project’s life. They include revenue risk, political instability, currency volatility, and climate disasters. Chronic risks typically play out at the macro level.

Lab solutions have championed various strategies to overcome these barriers, including standardization, aggregation, capacity building, blended finance, and credit enhancement. Below, we explore these concepts’ ability to increase climate finance in emerging markets.

1. Standardization streamlines bureaucracy and accelerates investment

Bureaucratic hurdles can stall investments. External delays can be caused by obtaining permits or land titles from government agencies, while internal holdups may include completing due diligence and negotiating contracts. Establishing common templates for agreements and procedures reduces administrative burdens for investors and project developers, streamlining project initiation and due diligence and speeding up project cycles.

Climate Investor One (CIO) has mobilized private finance at scale from investors, including NWB Bank, KLP Norway, and Aegon Asset Management, to become the most successful solution developed by the Lab, with USD 1.9 billion committed, including via spin-offs Climate Investor Two and Climate Investor Three. As an investment vehicle comprising three funds that work in tandem to finance renewable energy projects at different stages, CIO has standardized its investment process to reduce administrative burdens. By integrating separate funds for the development, construction, and operating periods, CIO simplifies negotiations between multiple capital providers, thereby streamlining the funding processes.

2. Aggregated portfolios better meet the needs of larger private investors

Since small projects often struggle to attract large investors due to high transaction costs, bundling several into a single investment package can achieve economies of scale and make them more attractive.

For example, the Sustainable Energy Bonds (SEB) India Lab-supported instrument has mobilized capital for small clean energy projects by aggregating them into a single diversified loan portfolio. Given that loans for small initiatives such as rooftop solar or energy efficiency retrofits often yield low per-transaction returns, the SEB bundled them in order to spread their fixed costs and create an appealing value proposition for investors.

Similarly, the Structured Finance for Nature (SFN) for Southeast Asia, which the Lab is supporting in 2024, proposes an aggregation approach to reduce bondholders’ repayment risks. It aims to do this by leveraging cash flows from new projects financed through the bond proceeds and existing projects already generating income.

3. Capacity building reduces pipeline risk

Emerging markets require support to build their expertise to adopt innovative financing approaches and create a steady flow of promising climate projects. This includes providing technical skills to create and maintain monitoring systems, as well as financial know-how to secure loans and manage finances. Technical assistance can range from helping with initial planning to ensuring the long-term operation of projects. By training developers, implementers, and other key players, Lab solutions empower them to structure, run, and monitor climate projects effectively – all of which help to build future project pipelines.

The Catalyst Fund, for example, offers pre-seed capital and bespoke venture-building support to foster innovation and promote adaptation solutions. The fund’s team of technical experts provides climate-focused startups with hands-on venture-building support to achieve product-market fit faster and build climate resilience among their customers. This grant-funded program includes an ecosystem-building facility to bolster the adaptation sector in Africa and make it more attractive for investment. The initiative benefits a range of players, from businesses receiving grants to private investors looking for promising opportunities. The Catalyst Fund’s current portfolio includes more than 20 climate startups in Tanzania, Kenya, Senegal, Egypt, Uganda, Morocco, and South Africa.

4. Blended finance mitigates risks and unlocks private capital

Chronic risks such as currency volatility, political instability, and revenue risk are common barriers to private investment in developing economies. These risks can be addressed by blending public and private investments to enable investors with different risk appetites to work together. Blended finance uses public and philanthropic funds to mobilize additional private capital. The Lab specializes in developing such instruments, which can alleviate private and commercial investors’ concerns regarding chronic risks.

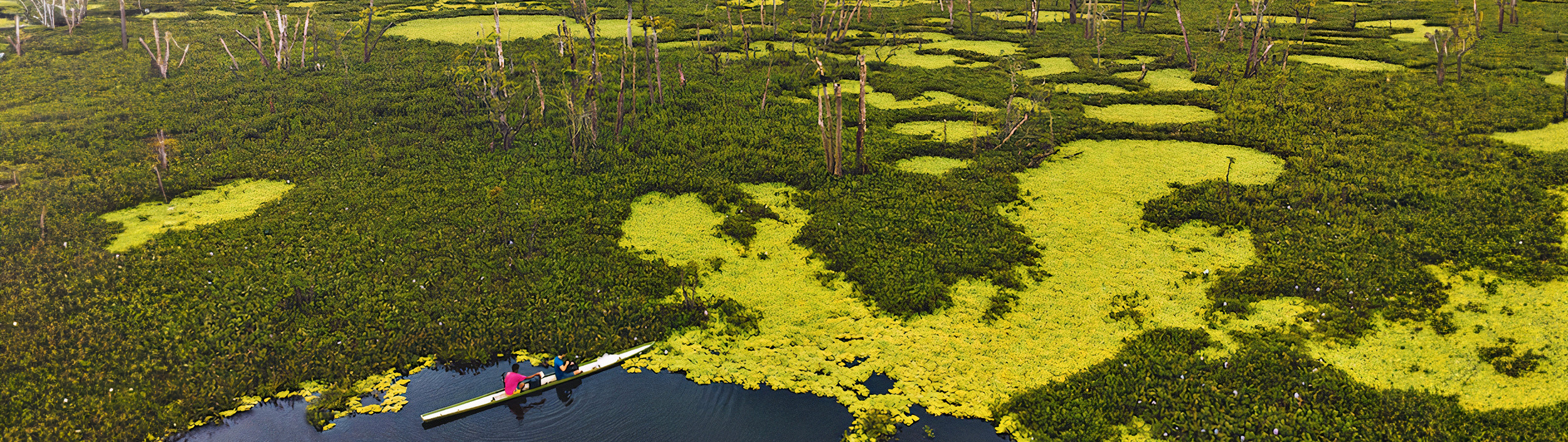

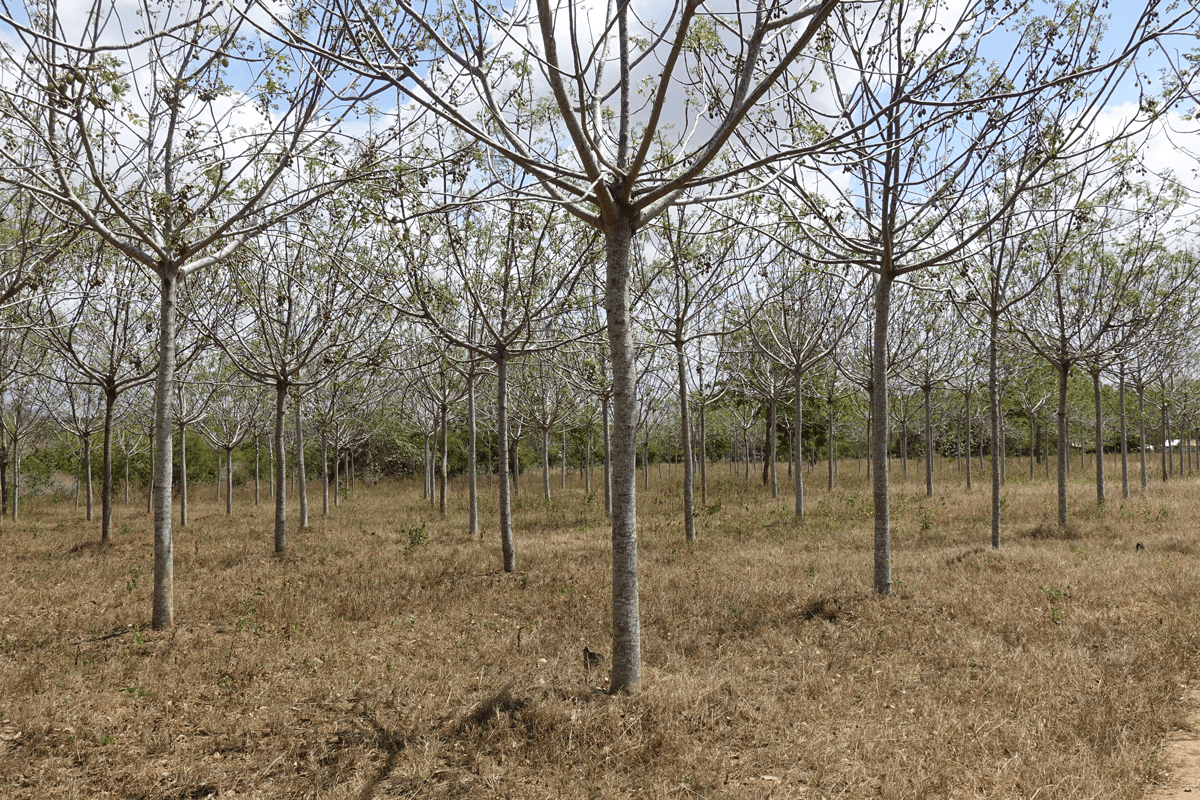

The Smallholder Forestry Vehicle (SFV) is one of many Lab instruments that uses blended finance to attract private capital. A first-loss tranche from public investors reduces risks and catalyzes additional private investment in the Kenyan forestry sector. The public tranche takes the initial loss if tree growth or crop yields fall below expectations. By mitigating revenue risk in a challenging market, SFV has attracted private investment from CI Ventures, a leading impact investor.

5. Credit enhancement levels the playing field

Credit enhancement is another valuable tool for making climate projects more competitive vis-a-vis conventional investments. It can help mitigate chronic risks related to currency fluctuations, political instability, and project performance. Guarantees act as a safety net, promising to fulfill a service or good if the original provider fails to do so. This injects a third party into the agreement, offering an extra layer of security for the beneficiary (usually an investor). On the other hand, insurance involves a direct agreement between an insurance provider and a policyholder. In case of a specific negative event causing harm or loss, the insurer provides financial compensation.

In response to the rising demand for risk mitigation tools, the Lab has expanded its portfolio of guarantee and insurance mechanisms. One example is the Green Guarantee Company (GGC), developed in 2022 under the Lab’s East and Southern Africa program. The GGC is an investment-grade (Fitch BBB/Stable) guarantor that enables public and private borrowers to access long-term debt from global credit and capital markets, mobilizing USD 100 million.

Strong public-private partnerships enable action

Trillions of dollars must come from private actors for the climate transition – the public sector simply does not have the funds. The Lab has emerged as a source of information on practical solutions to bridge the gap between public and private investors in developing economies. By employing multifaceted strategies to address challenges in these markets, Lab instruments have mobilized billions of dollars.

As demand for climate action intensifies, the Lab’s expertise in de-risking investments and building robust project pipelines remains crucial. By fostering collaboration between the public and private sectors, the Lab can unlock the vast potential of private capital and accelerate the transition to a sustainable future for all.

[1] Micro risks are firm-specific and can impact a project’s ability to generate revenue and investors’ ability to profit from their investment. In contrast, macro risks may affect all businesses or industries across geographic regions or countries.

Check out the entire Lab 10th Anniversary blog series

1. Five strategies to break down barriers to private climate investment

2. How a well-designed theory of change guides clearer social and environmental modeling

3. Building a compelling investment case for climate finance instruments

4. Making the most of concessional capital: The Lab’s blended finance approach

5. Enhancing the appeal of small-ticket investments with Sustainable Energy Bonds in India

6. Why Climate Adaptation Notes didn’t take off – and the lessons I learned

7. How Brazil’s Green FIDC became the Lab’s champion for private investment mobilization

8. Adaptation finance: Six key steps for structuring instruments that deliver results

9. Beyond box-ticking: Why gender-responsive climate finance is effective climate finance

10. Emerging trends, opportunities, and challenges in climate finance (17 September)

BONUS: A decade of the Lab: Finding a balance between climate finance and actionability (25 September)