About

Insurance, in the context of broader disaster risk management strategies, can increase community resilience and reduce recovery times when disaster strikes. Total economic losses to property and infrastructure from natural disasters averaged around USD 180 billion annually in the last decade, 70% of which are uninsured. Asian low and middle-income countries, in particular, have disproportionately low insurance coverage despite high susceptibility to natural disasters.

Understanding risk is critical for the management of extreme events and natural disasters. Yet high quality catastrophe risk models to assess and price the severity and probability of loss from climate-related risk are not readily available or adequately developed in Asian low and middle-income countries. Key barriers include the cost of model development and maintenance, lack of standardized hazard, exposure, and vulnerability data, and the difficulty in accessing locally available data and specialized knowledge. Under-developed insurance markets also inhibit demand for these products.

By providing access to transparent and standardized analytics, the Oasis Platform aims to improve understanding and management of climate-related risks, thereby facilitating investments in insurance and/or risk reduction.

The Oasis Platform for Catastrophe and Climate Change Risk Assessment and Adaptation (the “Platform”) is a set of tools that together aim to offer a more transparent, robust and comprehensive approach for analyzing and pricing risk from extreme events.

The Platform could strengthen climate resilience by helping to narrow the gap between insured and uninsured losses, and extending the use of catastrophe risk modeling beyond the insurance industry for risk-informed decision-making.

The Platform could directly save re/insurers 25-50% in modeling costs, catalyze USD 1-9 million in new risk model development, and indirectly generate ~USD 1.4 to 6 billion investment in property insurance coverage.

The Platform would reduce modeling costs and catalyze investment in model development by lowering transaction costs and enhancing competition. Were the Platform to become the modeling infrastructure underpinning the development of catastrophe risk insurance markets in the Philippines, Indonesia, and Bangladesh – the countries in Asia which The Lab Secretariat identified as the most suitable candidates for pilot projects and that have garnered the most interest from relevant stakeholders – the Platform could indirectly facilitate an additional USD 1.4 to 6 billion of property insurance coverage.

To demonstrate the use of the Platform in the identified Asian countries, proponents and potential implementing partners are developing strategic partnerships with suppliers and users of data and analytics, both in-country and with international public and private organizations. The Platform recently launched its pilot, the Oasis E-Market, in Asia in March 2017. The Oasis E-Market is a web-based marketplace to link demand and supply for risk analytics.

Proponents estimate that around USD 10 to 14 million in private and public investment would be needed to demonstrate the Platform’s potential.

In March 2017, the Oasis Platform launched the Oasis Hub, a pioneering global risk and climate adaptation information solution.

DESIGN

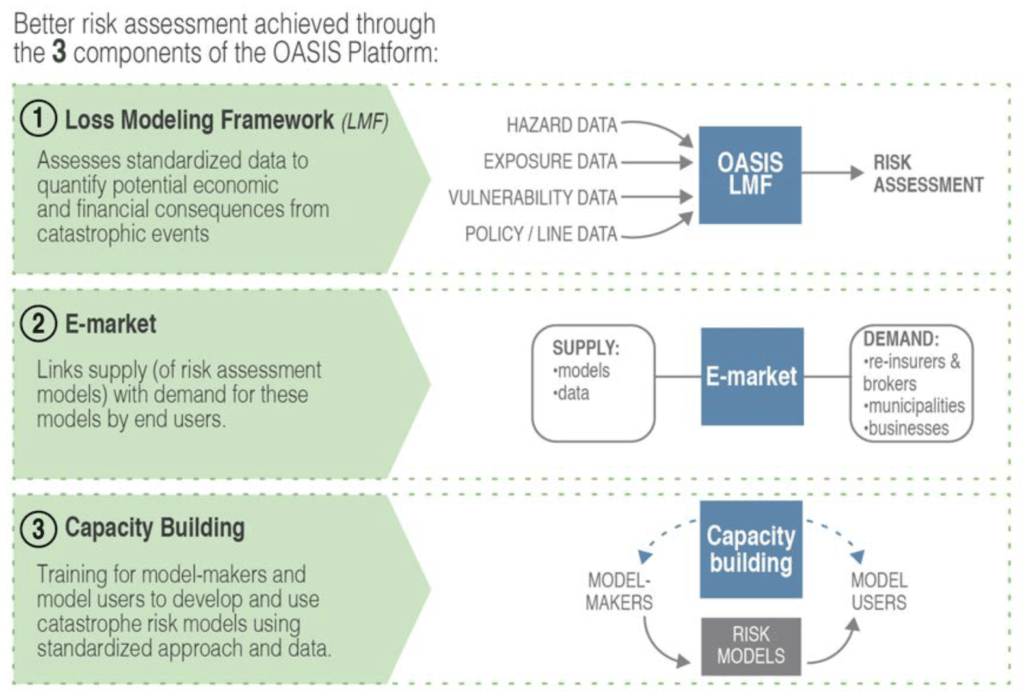

The Platform would achieve its aim through three main elements that together offer a comprehensive and transparent approach for analyzing and pricing risk or understanding costs from extreme events. These components, which are at different stages of development and can also work independently, are:

- A Loss Modeling Framework: Open source loss modeling software to allow users to ‘plug-and-play’ a range of standardized data to calculate the potential economic damages and financial risk of catastrophic events;

- An e-Market: An open access web-based marketplace to link demand for risk analytics with suppliers of data, models, tools and services;

- Capacity building: Training to model developers and users to increase their ability to develop and use catastrophe risk models compatible with the Platform and that can meet the needs of a range of users, including re/insurers.

In addition to these components, proponents have also initiated the development of a global exposure database to provide key inputs to risk models.

More information at: https://www.oasishub.co.uk/