The Low-Carbon Agriculture Transition Mechanism (LATM) offers small- and medium-sized Brazilian farmers long-term loans while guaranteeing a minimum income and technical assistance, accelerating climate transition in agriculture.

ABOUT

Brazil is a significant emitter of greenhouse gases, and its emissions increased by 12.2% in 2021. Deforestation accounts for 49% of Brazil’s emissions, while agriculture represents 25%. Despite this, Brazil has pledged to reduce greenhouse gas (GHG) emissions by 50% below 2005 levels by 2030 in its revised Nationally Determined Contribution (NDC). Low-carbon agriculture can help Brazil address deforestation in the Amazon, Cerrado, and Atlantic Forest biomes while reducing emissions and increasing productivity. However, access to technical assistance and investors’ risk perception are barriers that LATM intends to overcome.

INNOVATION

LATM is Brazil’s first financial instrument to support the sustainable agricultural transition by offering an income guarantee based on a portfolio risk management approach, addressing opportunity costs that hinder investments. Producers transitioning to sustainable agriculture will have their income guaranteed if they experience low productivity and revenue. In addition, the mechanism provides four credit lines designed to offer a portfolio approach to reduce risks and interest rates related to investments in agroforestry systems and bioeconomy, making these more attractive.

“There is an extreme amount of knowledge in the Lab network that we can learn from to make our fund market ready, as well as share a lot of our on-the-ground experience in creating debt mechanisms that will really make money flow to producers on the ground and with the potential to scale.”

Martha de Sá, Founder of Violet

“We are super excited to be part of the Lab network. This instrument is a further step toward achieving our mission by directing money in a very impactful way to support farmers in their land use transition. The Lab knowledge and support will be fundamental to overcome the challenges of unlocking this type of capital.”

Gilberto Ribeiro, CIO of Vox Capital

IMPACT

The mechanism aims to deliver sustainable returns based on changes in usual industrial commodities production or small-scale agriculture.

The Commercial Phase will implement the Transition Guarantee Facility and apply the four credit lines from a portfolio risk management approach. This phase relies on concessional and commercial capital, enabling the set-up of the initial portfolio. It aims to raise USD 100 million for the Revolving Debt Program, with 30% concessional debt for the first loss. Technical Assistance and the Transition Guarantee Facility require USD 15 million in non-refundable grants.

LATM’s Commercial Phase targets 78,000ha of land for sustainable agricultural practices – equivalent to New York City’s size – covering areas in the Amazon, Cerrado, and the Atlantic Rainforest, benefiting 3,659 farmers.

DESIGN

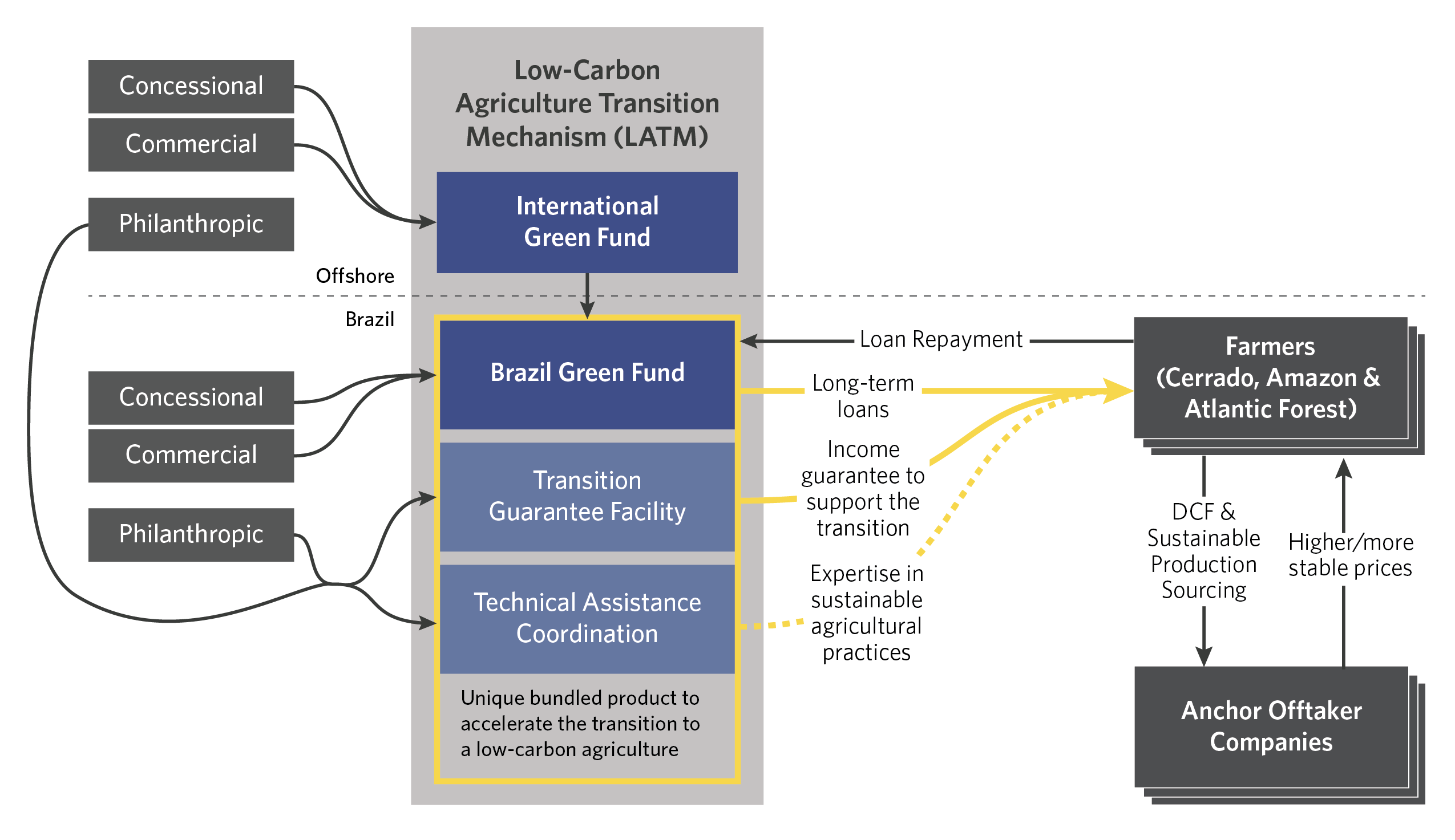

LATM includes a Transition Guarantee Facility, a Revolving Debt Program, and Technical Assistance Coordination. The mechanism also has a two-level funding structure: an offshore green fund and a Brazil green fund.

- Transition Guarantee Facility: provides an income guarantee for producers who experienced reduced productivity and revenue in the first years due to the practices engaged for the transition, reducing their aversion to sustainable practices.

- Revolving Debt Program: provides small- and medium-sized farmers loans to finance their sustainable agriculture transition under four specific credit lines: Pasture Recovery, Sustainable Livestock Intensification, Integrated Systems, and Agroforestry and Bioeconomy. The loans are provided over ten years and are based on the specific transition characteristics of the farmer.

- Technical Assistance Coordination: covers a range of topics: (1) Identifying the most appropriate sustainable practices for the farmer’s land, (2) Developing a transition plan, (3) Providing training on sustainable agricultural practices, and (4) Monitoring the farmer’s progress.

In addition, LATM includes a two-level structure for funding. The first is an offshore green fund incorporated in a foreign jurisdiction for international private investors interested in sourcing sustainable agricultural and forest products. The second is incorporated under local regulations and funded by the offshore green fund and local investors.