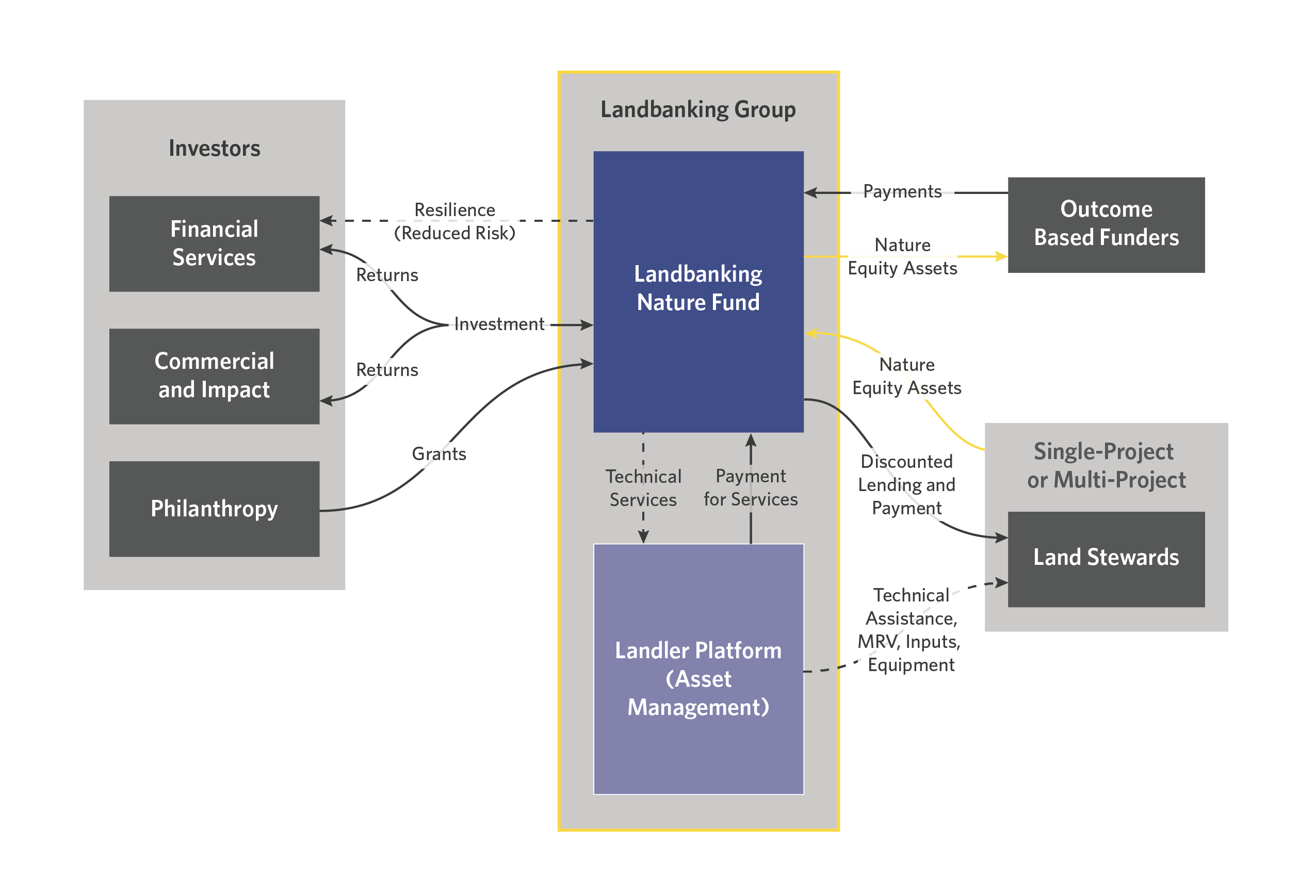

The Landbanking Group (TLG) has created a new methodology for valuing nature and a market mechanism (Nature Equity Assets) to allow direct investment into natural capital stocks – biodiversity, carbon, soil, and water.

ABOUT

High Integrity Forests (HIFs) provide critical environmental ecosystem services such as carbon sequestration and storage, support biodiversity, preservation of water tables that support climate resilience of surrounding areas, as well as extreme weather mitigation, non-timber forest products, and social and cultural benefits for Indigenous Peoples and local communities (IPLCs).

Despite this, HIF preservation has historically been difficult to monetize, with value only assigned when HIFs are degraded to make way for infrastructure, agriculture, pasture, or extractive industries. Both land stewards and investors have lacked financial incentives to protect and restore forests.

INNOVATION

TLG’s mechanism aligns incentives between business value and natural capital preservation and regeneration by land stewards. The dollar value of contracts reflects the value of natural capital to the purchaser (OutcomeBased Funders) and can be held on their balance sheet.

Many entities (OBFs) need to invest in forest landscapes either because they depend on the services the forest provides or because they seek to mitigate negative impacts elsewhere. TLG’s mechanism aggregates these entities, enhancing project bankability.

The mechanism is underpinned by continuous monitoring of natural capital using the latest MRV technology. Therefore, the purchaser can constantly track the performance of investment contracts, creating trust.

“In partnering with the Lab, we hope to strengthen our platform and reward land stewards around the world for natural capital uplift.”

Dr. Martin R. Stuchtey, Founder of The Landbanking Group

IMPACT

The instrument increases the amount of financial capital allocated to natural capital – helping to fill the annual USD 800 billion nature funding gap.

The Landler Platform (which facilitates investments) utilizes technology to remove middlemen from transactions, increasing trust and the financing that reaches the communities stewarding forest ecosystems.

TLG starts by piloting agroforestry projects in the cocoa supply chain and forest protection projects linked to soy supply chains before expanding to other markets, including projects that don’t have strong value chain links, such as bioeconomy projects in Suriname and conservation projects in Africa.

DESIGN

The instrument will start as a series of Special Purpose Vehicles (SPV), eventually becoming a Fund that will act as an intermediary between investors, OBFs, and land stewards to support the investment in Nature Equity Assets. The Landler Platform underpins the instrument, monitoring natural capital stocks and issuing Nature Equity Assets by verifying that natural capital has been preserved or regenerated.

Commercial and impact investors and philanthropists provide capital in the form of debt, equity, or grants to the Fund. This increases the working capital available to land stewards, enabling them to invest in equipment or seeds required to develop an agroforestry system and cover operational costs for the project’s duration. Financial services provide land stewards with low-interest credit lines to further increase working capital.

The project generates Nature Equity Assets, which are purchased by outcome-based funders.

Investor returns are based on the sale of Nature Equity Assets, while financial service returns are based on the lower risk profile of its debt portfolio.