Growth Next-Generation Agriculture (GAN) is a climate resilience debt fund accelerating Brazil’s transition to regenerative agriculture. It works through financing the purchase of biological inputs by farmers from local small and medium-sized enterprises (SMEs).

ABOUT

Brazil’s agriculture relies heavily on chemical inputs, which can degrade soil health and contribute to greenhouse gas (GHG) emissions. Transitioning to biological inputs is crucial for restoring environmental sustainability and meeting Brazil’s climate goals. However, large market participants selling chemical inputs are inhibiting this transition. These companies offer comprehensive services, including financing, training, and technical assistance, which makes it difficult for smaller biological input providers to compete. This system limits farmers’ access to alternative biological inputs and slows the adoption of regenerative agriculture practices.

INNOVATION

Growth Next-Generation Agriculture (GAN) revolutionizes agricultural finance by redefining risk assessment through AI-driven credit analysis, breaking barriers of traditional methodologies. The solution curates companies, conducts qualitative studies, and evaluates growth potential. At the heart of this innovation lies a robust tech stack tailored specifically for agriculture, seamlessly supporting the credit analysis process and dynamically assessing eligibility criteria. This dynamic approach is further fortified by a dedicated credit and impact committee, ensuring allocation of funds while propelling the transition from conventional guarantees towards portfolio diversification. By facilitating greater access to capital and expediting sales, GAN catalyzes the acceleration of sustainable progress within tropical agriculture.

“We believe effective finance strategies for climate change require collaborative models. Applying for the Lab offers us the chance to connect the agricultural value chain with our technology, finance, and sustainable practices expertise, aligning with world-leading institutions in climate policy development. We aim to test design possibilities, define impact indicators, establish a management committee, map potential funders, and collaboratively build a sustainable financial product for new tropical agriculture stakeholders.”

Mauricio Quintella, CBO at Traive Finance

IMPACT

GAN will invest BRL 250 million (USD 44.4 million) in approximately ten securitizations issued by established Brazilian biological input SMEs for its demonstration fund. These SMEs sell biological fertilizers, pesticides, and other bio-inputs to farmers, primarily cultivating soybeans and corn. The demonstration fund will prove GAN’s commercial viability, paving the way for larger scale investments and potential expansion to other Latin American markets. With Brazil’s total market for chemical fertilizers reaching BRL 200 billion (USD 35 billion), GAN has a significant opportunity to catalyze a shift towards regenerative agriculture.

DESIGN

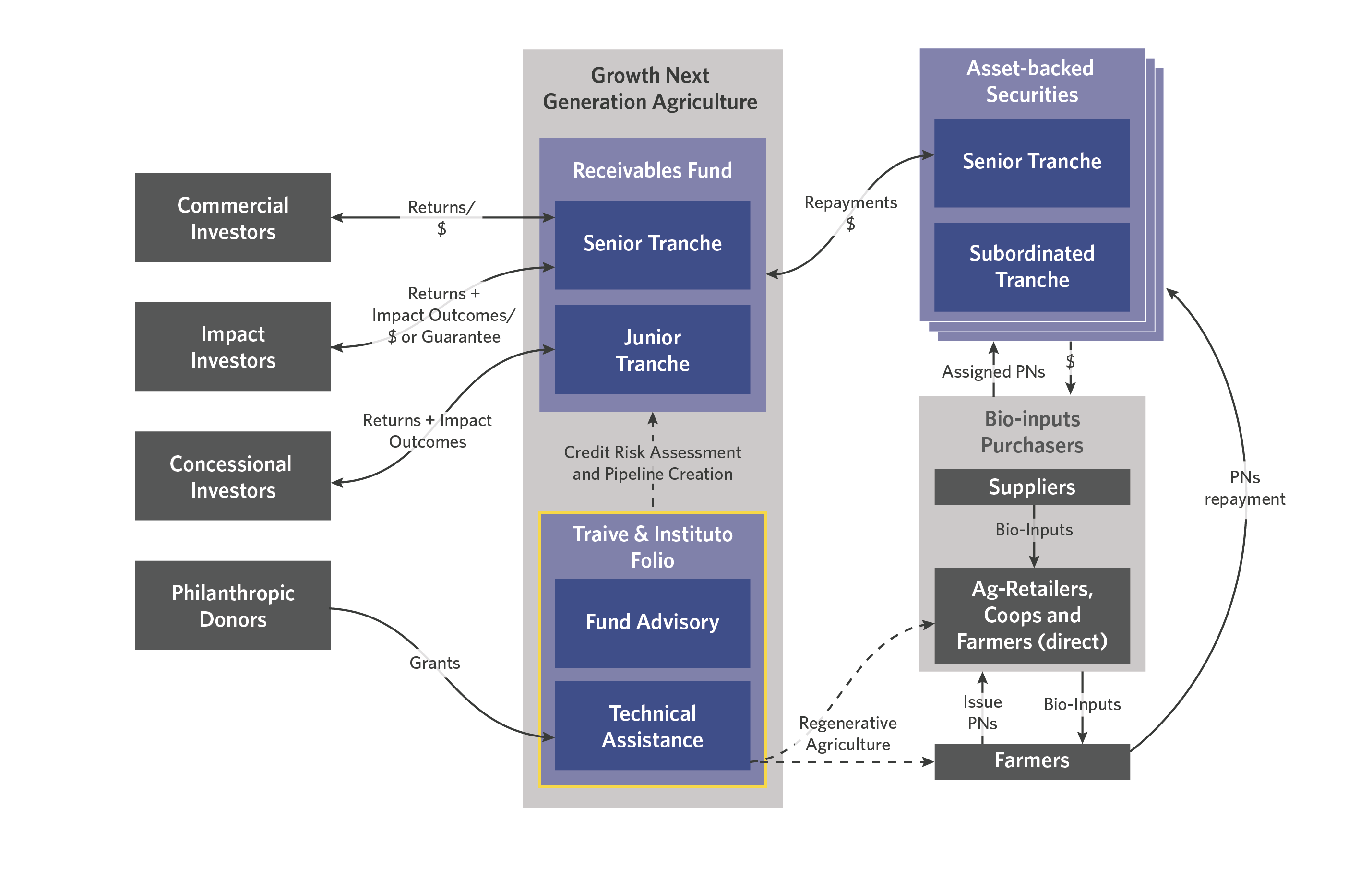

GAN is a debt fund that finances farmers’ purchase of biological inputs from SMEs through asset-backed securities (ABSs). The fund structure leverages a common Brazilian receivables instrument, a FIDC, to invest in securitized receivables issued by bio-input SMEs. These SMEs, in turn, offer credit to farmers for purchasing their products, driving market growth and accelerating the transition to regenerative agriculture.

GAN employs a blended finance structure with a senior tranche financed by commercial and impact investors and a junior tranche supported by concessional capital providers. This structure mitigates investment risk while maximizing market-rate returns for the senior tranche. Traive will originate securitizations in partnership with Folio, which provides technical assistance to accelerate the adoption of regenerative practices.

By addressing the critical barrier of access to affordable working capital for biological input SMEs, GAN aims to catalyze Brazil’s transition to regenerative agriculture. The Fund’s innovative investments, combined with the deep expertise of Traive and Folio, position it as a powerful tool to drive climate resilience in Brazil.