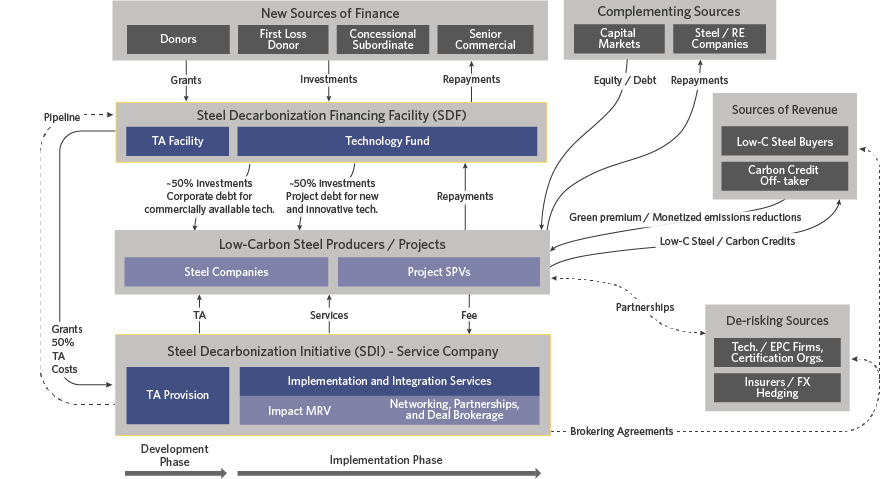

The FSD mechanism consists of two financially and legally separate entities – the Steel Decarbonization Financing Facility (SDF), and the Steel Decarbonization Initiative (SDI).

SDF consists of a blended debt Technology Fund, capitalized equally by concessional and commercial finance, that will invest nearly USD 1 billion over five years into both commercially available, and new and innovative technologies, and a complementing technical assistance facility that will provide early-stage support for project preparation to steel companies through grants and, in turn, create a pipeline of bankable projects for the fund.

SDI will be a one-stop service provider to steel companies for developing and implementing decarbonization projects. Depending on the needs and the development stage of the project, the services provided by SDI will include (1) technical assistance; (2) impact monitoring, verification, and reporting to investors and stakeholders; (3) facilitation of off-take agreements for steel companies with customers of value products like green steel, carbon credits and captured CO2; (4) a platform for networking and partnering with wider ecosystem players. These essential bespoke services by SDI will be bundled to mitigate investment risks and promote stakeholder transparency.